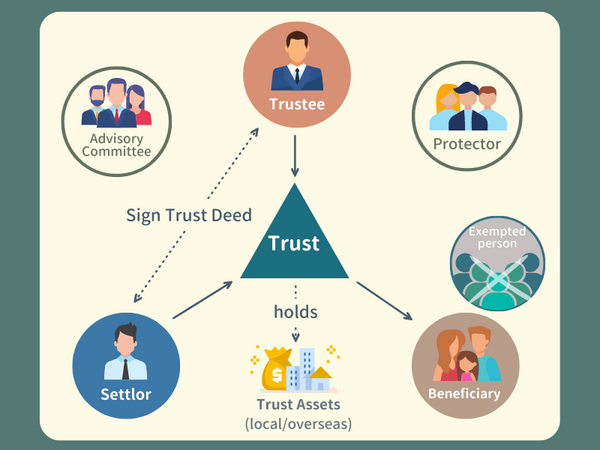

Trust is created by the Settlor.

The Settlor identifies the Beneficiaries and transfer all or part of his/her assets into the Trust.

Trust assets may include but not limited to:

- Bank Deposits

- Shares and Bonds

- Insurance Policies

- Art Collection

- Real Property

- Companies

Trustee carries out and administers the Trust in accordance with its terms and acts in the best interest of the Beneficiaries.

Trustee duties include:

- Legal title of Trust assets

- Management of bank accounts

- Tax reporting

- Keep accounts and records of the Trust

- Manage and administer the trust

- Others as may be discussed between Settlor and Trustee

Trust Beneficiaries will benefit from the Trust.

Examples of Beneficiaries:

- Settlor

- Spouse

- Children and grand children

- Charitable organisations

A Protector may be appointed under a Trust Deed to exercise certain powers in relation to the Trust.

They provide check and balance over the Trustee and act as a watchdog for the Beneficiaries.

An Advisory Committee (e.g. Investment Advisor) may be appointed under a Trust Deed to exercise certain powers in relation to the Trust.

They provide financial and / or investment advisor to Trustee. They may also review financial records of the Trust, to ensure effective management of the Trust.

*Settlor may depending on his/her objectives of setting the Trust to determine whether to appoint a Protector and Advisory Committee.

Neither of these two roles are a must for the Trust to be established.