As advocating for economic independence and investment diversification have become more popular in recent years, many people focus on the privacy of their investments and may not even want their family to know how much investment assets they have. However, they are also afraid that nobody will know about these assets after they pass away, leading to difficulties for their family to inherit them.

Putting different investment assets into a trust can help you:

- Ensure higher privacy for your investments during your lifetime

- Ensure that your assets are distributed according to your wishes after your pass away

- Facilitate the management of diversified investments

- Protect assets from interference by creditors and other claimants

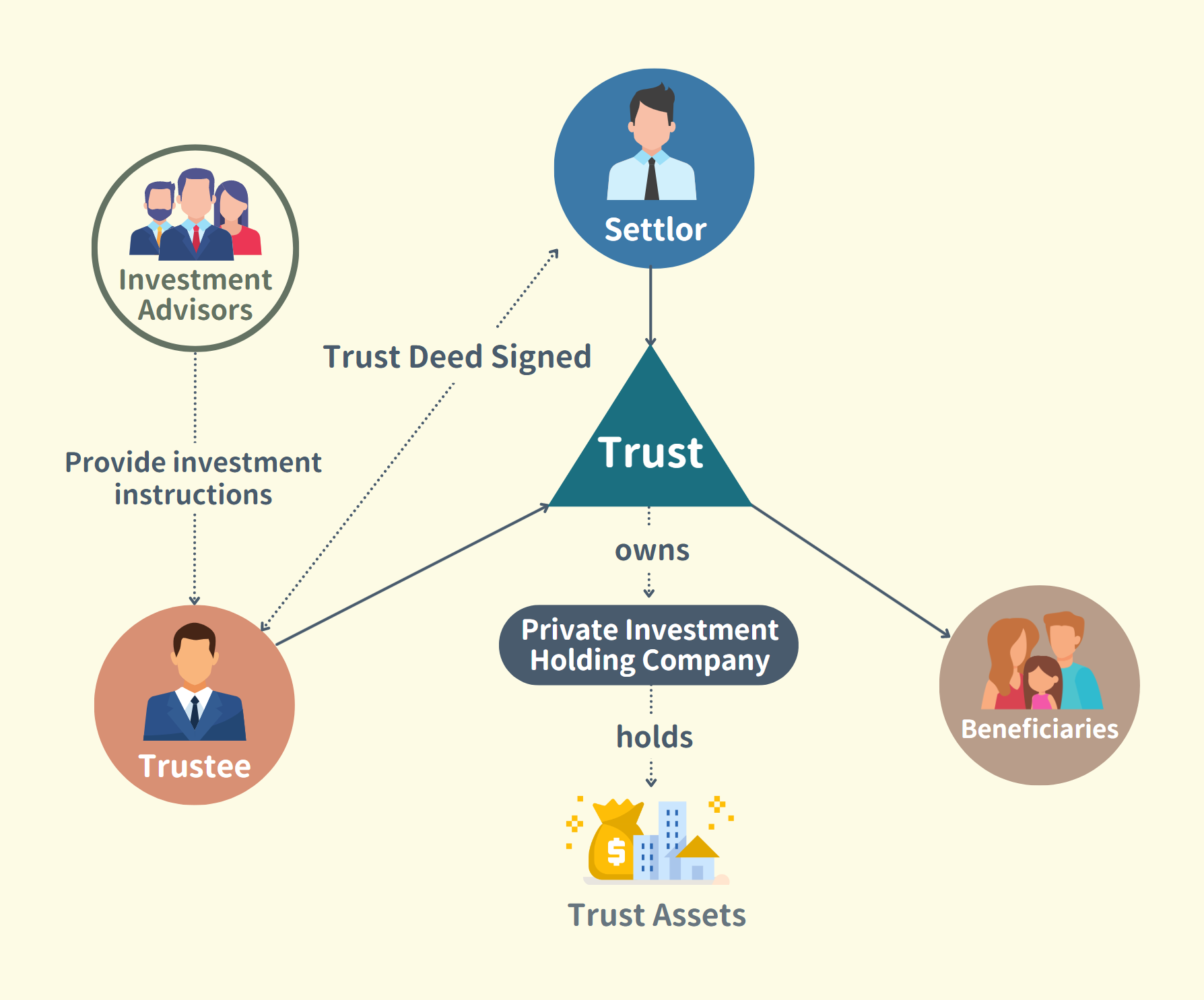

General Structure of Trust

Settlor (i.e. Investor)

Trust is created by the Settlor. The Settlor identifies the Beneficiaries and transfer all or part of his/her investment assets into the Trust.

Trustee

Trustee carries out and administers the Trust in accordance with its terms and acts in the best interest of the Beneficiaries.

Trustee duties include:

- Legal title of Trust assets

- Management of bank accounts

- Tax reporting

- Keep accounts and records of the Trust

- Manage and administer the trust

- Others as may be discussed between Settlor and Trustee

Beneficiaries

Trust Beneficiaries will benefit from the Trust.

In Investment Trust, the primary beneficiary is:

- the Settlor

Examples of secondary beneficiaries:

- Spouse;

- Children;

- Grandchildren;

- Charities; and/or

- Any others the settlor wishes to name

Investment Advisor

Investment advisors can be individuals or companies designated by the settlor, responsible for providing investment instructions to the trustee for management and distribution.

Trust Assets

Common examples of investment trust asset:

- Cash/bank deposits

- Stocks

- Bonds

- Real estate

- Funds

- Insurance policies

- Cryptocurrencies/NFTs

- Vehicles/boats

- Collectibles

Please feel free to contact us to learn more about trust for investment.